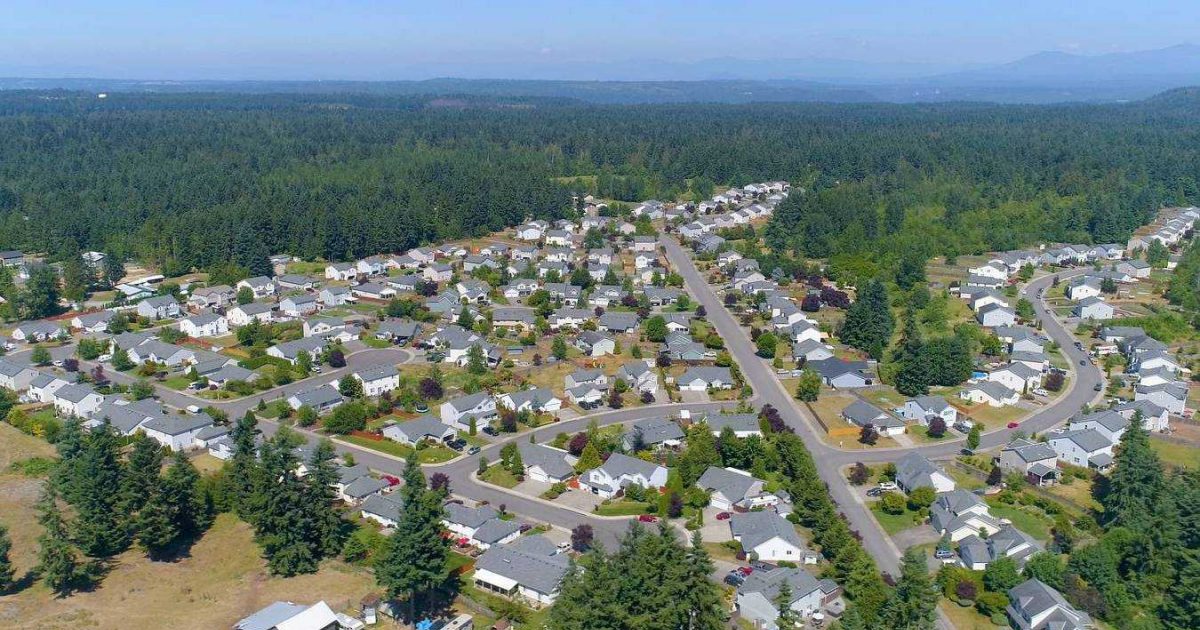

Because of the rapid rise in home prices in the Pierce County area and throughout much of the United States, many people are assuming that we must be in a housing bubble.

Since May of 2019, here’s how much local median home prices are up in Pierce County and in neighboring counties:

Pierce County +37%*

King County +25%**

Thurston County +31%*

Kitsap County +27%*

*median price of residential/condo

**median price of residential only

Nationally since 2012, the increase in housing values is at 126%.

Someone who lived through the housing crisis of 2007-2009 might be experiencing some “déjà vu” with our current real estate market. However, there are many differences between what is happening now and what happened back in 2007-2009.

One of the major reasons that we’re not currently in a housing bubble is because the quality of home buyer’s credit along with the types of loans they are utilizing is vastly different from the pre-bubble buyer.

Another reason we are not in a housing bubble is because today we have a classic supply and demand scenario that does not compare to what happened in the mid-2000s.

The previous housing crisis would be better described as a crisis that resulted from political and lending policies and how these policies affected the housing market. We often describe it as a housing crisis, but that is not the whole story.

Financing Differences Between Now & Then

To be a bubble, we need a large percentage of speculative buying.

The buyers in this market are largely owner occupied, and their down payment and the quality of their credit is much higher than pre-bubble days. The average FICO score in 2005 leading up to the bubble was 715 compared to 788 today.

In 2005, 39.4% of ALL mortgages were some type of the subprime variety and 90% of those were ARM or Adjustable Rate Mortgages. 29% were negative amortization, and 28% were -0- down. Today, only 3.1% of mortgages have an ARM component. Lenders today have very little appetite for risky loans, and credit requirements are much tighter due to government and banking policies.

The Millennial Generation = The Largest Group of Home Buyers Today

The largest cohort of buyers today are from the Millennial generation, which, by the way, is the largest generation to move through our economy since the Baby Boomers. Millennials are entering the prime age for home buying; in fact, 9.6 million of Millennials will turn 30 in the next 2 years. These young people are forming new households and want to participate in the age-old American dream of owning a home. For years after the last housing crash, many said this generation would be a generation of renters. Turns out that is not true as they get married, start families, etc.

Investors Are Feeling Confident

That said, there are “investors” in the market alongside owner occupants for sure. These investors, some of which are large institutional hedge funds and the like, have a strong conviction of the future of U.S. home values. This, along with the precipitous rise in rents has helped fuel the investor demand, but they are not speculators in the sense that their business model relies solely on appreciation.

How Much Has COVID-19 Affected the Demand for Housing?

The current demand is not due to COVID-19 either, although it did serve as an additional catalyst to trends that were already in play. As COVID-19 locked us down, it highlighted the importance of “home.” Since we had to spend so much more time at home, a simple crash pad in an urban setting was not proving to be enough for many. Plus, if other members of the family are home all at the same time, the need to simultaneously accommodate Zoom meetings, school sessions, etc., meant that many people could really use a larger space… and it had many people feeling like a big backyard sure would be nice, too!

There’s a Housing Shortage

Despite our growth in population and changing demographics resulting in high demand, there are simply not enough houses for sale. In fact, nationally we see 36% fewer houses for sale today than we had in 2005. In Pierce County during May of 2006 vs May of 2021, there are 84% fewer homes for sale.

Not enough homes are being built, and this has been going on for some time. In 2007 the nation saw 1.7 million residential permits applied for compared to under 1 million in 2020. The NAR says that based on the historical average, 1 permit is issued for every 2 new jobs. For the period ending in December 2019 in the Seattle-Tacoma/Bellevue area, 28,508 single family permits were issued with 136,000 new jobs.

—

Whether you are buying or selling a home in this market (or both), you need an experienced Pierce County real estate expert to guide you through the process. Reach out if you’d like to connect!

This post originally appeared on windermerepc.com by Michael Robinson

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link